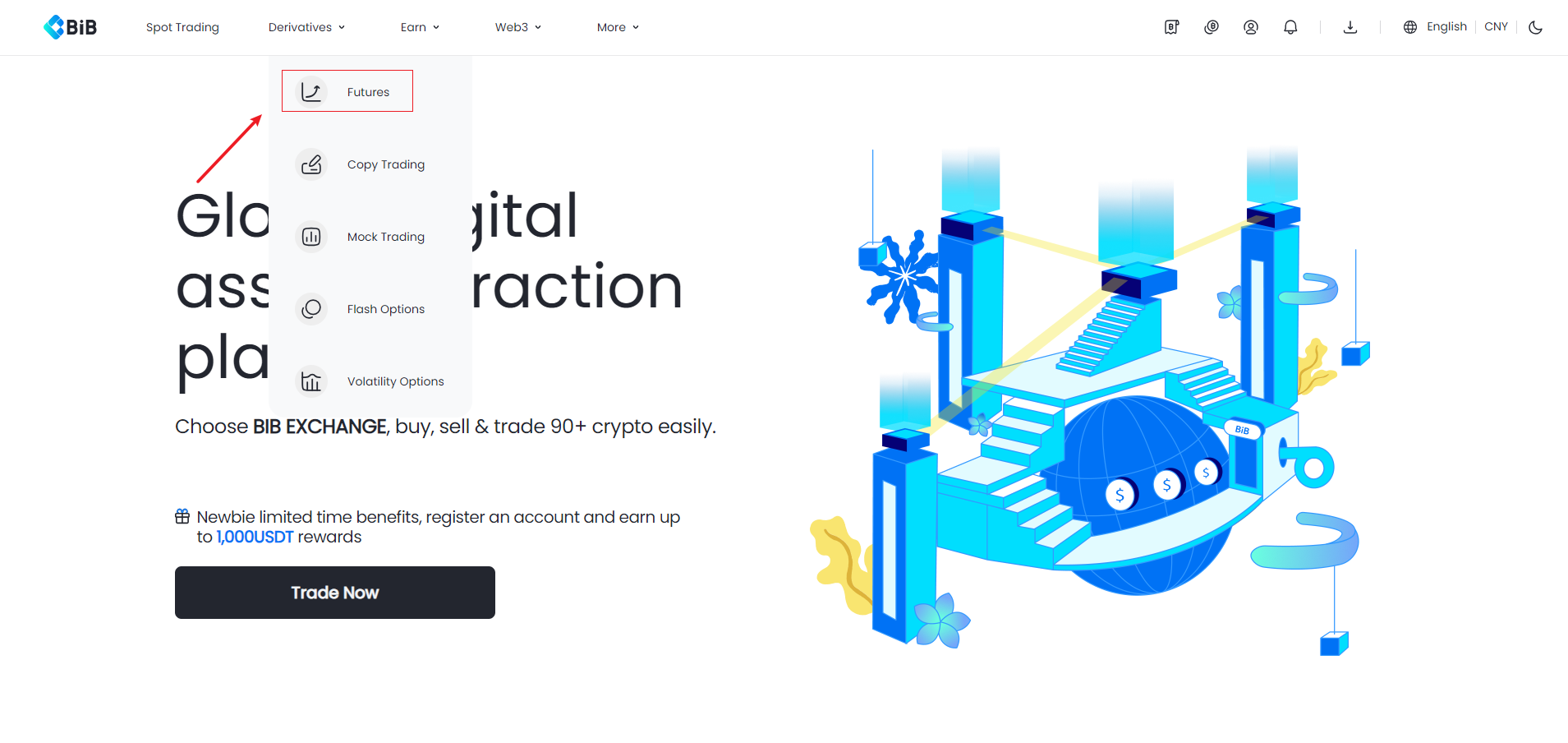

1. From https://www.bibvip.com/en_US, click [Derivatives] then [Futures] to access the Futures page.

2. The futures page contains a wealth of data about the market. This is the price chart of your selected trading pair. You may change your trading pair by clicking the menu icon in the top left corner of the screen. Information about your positions and orders can be seen at the bottom of the screen. The order book gives you insight into whether other brokerages are buying and selling while the market trades section gives you information about the recently completed trades. Finally, you can place an order on the extreme right of the screen.

3. (1) Trading

a. USDT contracts are perpetual contracts denominated and settled USDT.

b. Expiration: Perpetual

c. You will not incur excessive fees as there is no additional conversion required when trading with USDT.

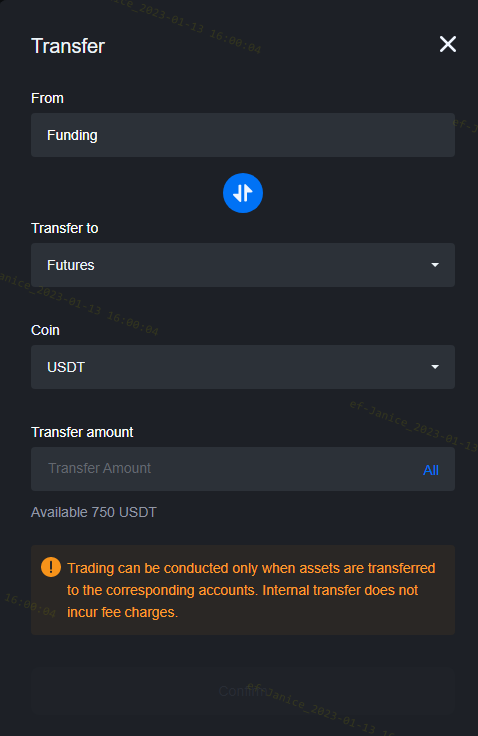

(2) Transfer Assets

In order to trade futures, traders will have to transfer assets from their Funding account to their Futures account.

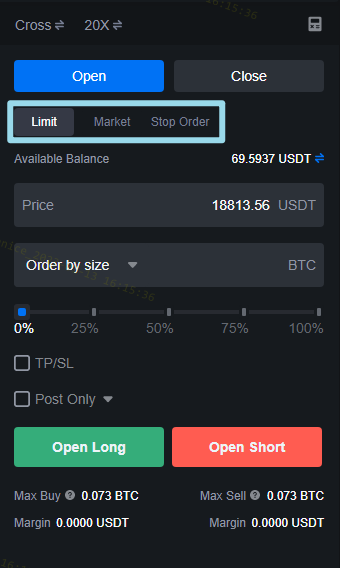

4. Leverage

You may apply different amounts of leverage on different trading pairs. BIB supports up to 125X leverage. Your maximum allowable leverage is dependent on the initial margin and maintenance margin, which determines the funds required to first open and then maintain a position.

5. Buy/long & Sell/short

(1)Buy/long

If a trader judges that the market price of a certain contract will rise in the future, they can buy a certain number of contracts and hold them in anticipation of a price increase. The trader can then sell them for a profit and close their position.

(2)Sell/short

If a trader judges that the market price of a certain contract will fall in the future, he can borrow contracts to sell. When the price falls, the trader can close out the position by buying those contracts back at a lower rate and earning the difference.

6. Definitions

BIB supports different orders for users to trade futures.

(1)Limit order

The limit order allows a trader to specify the buy or sell price at which their order will be fulfilled.

(2)Market order

The market order is the immediate execution of a trade at market rate. It is often used when traders would like to make an emergency transaction.

(3)Stop Limit

In a stop-limit order, the stop price is the trigger price for the exchange to place a limit order. Users need to set a trigger price first, and then choose the order type (limit or market) and open value. When the price hits the trigger price you set, the order will be placed automatically. You can strategically place stop-limit orders by considering resistance and support levels and the asset's volatility.

(4)P/O (Post Only)

Post Only Orders are added to the order book when you place the order, but they are not executed immediately. In other words, this condition is designed to ensure that you will become a maker to enjoy lower trading fee. If that is not the case, the order will be immediately canceled.

(5)IOC (Immediate-Or -Cancel)

An immediate-or-cancel order is one which has to be executed immediately and fully, and any portion of an IOC order that cannot be filled immediately will be canceled.

(6)FOK (Fill-Or-Kill)

This order is instructed to execute in full immediately (filled), otherwise it will be canceled (killed).

(7)TP/SL

You can set a [take profit] or [stop loss] price before opening a position or when you are holding your position. You will be able to set the [Take Profit] and [Stop Loss] orders simultaneously. After closing the position, the TP/SL will be automatically canceled.

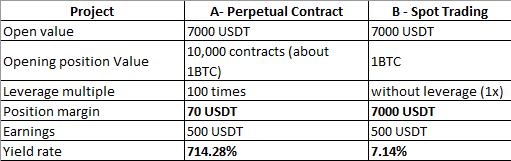

Example:

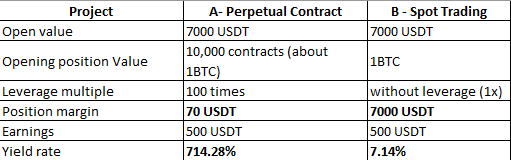

Traders A and B have both opened a trade in BTC. Trader A uses a BTC/USDT perpetual contract with 100x leverage while B buys BTC directly with no leverage. The price of BTC when the positions are opened is 7000 USDT.

Buy/Long Case

Here’s what happens when the price of BTC rises to 7500 USDT:

Sell/Short Case

Here’s what happens when the price of BTC drops to 6500 USDT.

You may use the calculator function provided on the BIB platform to perform your calculations before making a trade.